To enhance competitive advantage in today’s ever-changing market, it is indispensable for banking and finance organizations to offer superior services to attract new customers and businesses. Efficient and accurate data handling can help to remove costly and error-prone manual work from intensive paper-oriented operations and speed up the overall process.

VitalCapture, VitalDoc and VitalFlow

With VitalCapture, VitalDoc and VitalFlow adopted in banking and finance business operations, customer service teams in the face-paced environment of branches can easily capture customers’ documents, extract and validate relevant data, and send it to the back-end repository within the customer’s visit for account opening, mortgage/ loan applications and more. Missing or incorrect data can be routed through an exception handling process in VitalCapture to ensure only correct and high-quality data is submitted and follow-up effort is minimized.

Streamlining Application Handling

With VitalCapture’s web interface and mobile capturing function, frontline representatives can easily automate scanning, indexing and filing of customers’ paper forms and documents to the secure VitalDoc repository with pre-defined folder structure, enabling instant retrieval and processing by authorized personnel. It greatly reduces manual entry work and prevents human errors.

|

Smart Form Data Capture

Key information on customers' account opening and various application forms together with personal identity and address proofs, income statements and other supporting documents is automatically extracted by VitalCapture with accurate optical character recognition (OCR) and data validation according to pre-defined rules and matrixes for processing different file types.

|

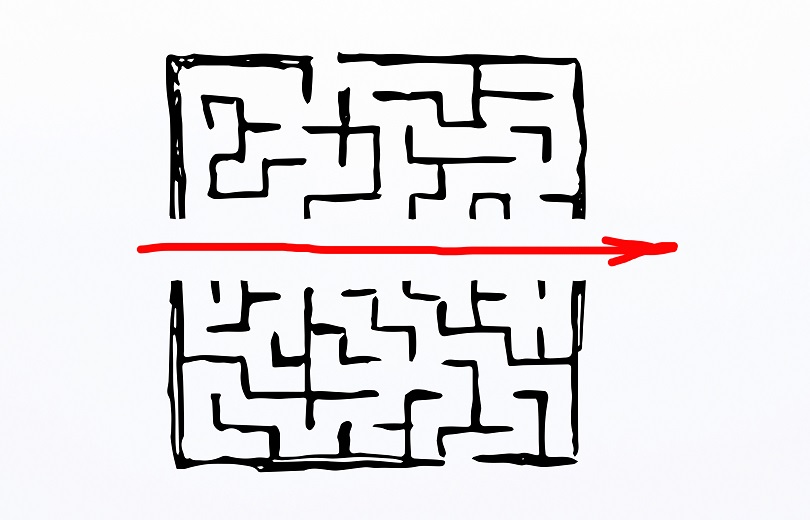

Business Workflow Automation

VitalFlow allows users to design and configure approval and other workflows by simple drag-and-drop and provides web-service APIs for easy integration with other internal systems. It automates complex internal review and approval tasks of different departments and teams to action-taker roles based on pre-defined criteria and provides email alerts and SMS notifications.

|

Intelligent Data Repository

Market-proven VitalDoc empowers documentation with promising enterprise-grade system security, providing user access control from folder to file level with AES 256-bit encryption for data at rest. It enables staff of specified roles to retrieve documents by index, content, keyword and more through smart searching tools and provides a secure document viewer for extra confidentiality.

|

Check out our customers fulfilling their operational needs with VITOVA's industry-driven data management solutions.

Know MoreSimply make a request to know how to leverage VITOVA in your Banking & Finance operations:

Level 10, Cyberport 2

100 Cyberport Road

Hong Kong

|

| Tel: (852) 2503 8000 |

| Fax: (852) 2503 8404 |

| Email: info@vitova.com |